Case Study

Leading Multinational Financial Services Company Boosts Customer Satisfaction with Conversational AI

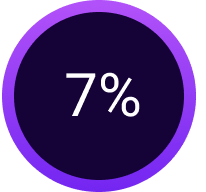

5

%

authentication increase since 2020

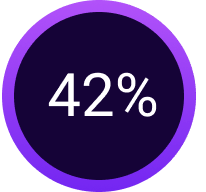

5

%

increase in IVR contained calls

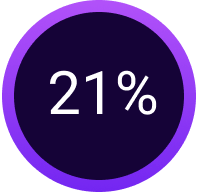

10

%

decrease in IVR talk time

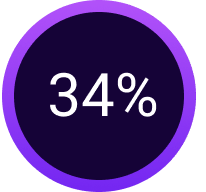

20

%

increase in authentication success